- Tax, Legal & Accounting

- 3 min read

ICAI defends action against EY affiliates, says move in sync with its statutory power

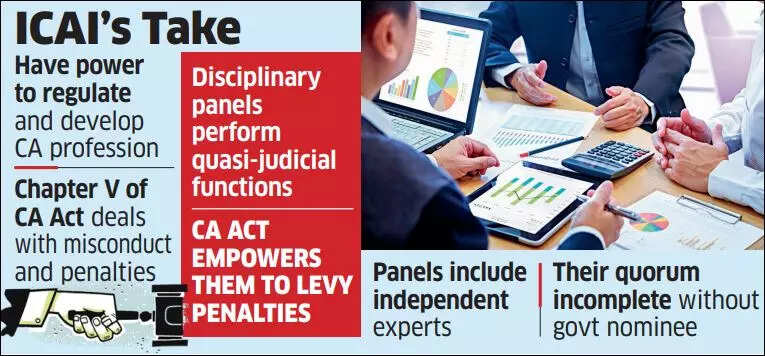

ICAI defends action against EY affiliates, cites statutory power. Delhi HC stays order. ICAI directs firms to end tie-ups violating norms. Accusations of bias. Supreme Court involvement.The Institute of Chartered Accountants of India (ICAI) has defended its last week order against auditing major EY's three affiliates and a retired partner for professional misconduct, and asserted that it has statutory power to initiate action, including against local affiliates of multinational accounting firms.

In its first public response since it passed the order, the institute sought to scotch any allegation of impropriety or prejudice in its action against the Big Five audit firms, in an email reply to ET.

It said the Board of Discipline and Multiple Disciplinary Committees, formed under the Chartered Accountant Act, 1949, comprise independent external experts on finance, taxation and administration “who are persons of eminence nominated by the government of India”.

On Thursday, the Delhi High Court stayed the ICAI order against the EY affiliate firms -- SR Batliboi & Associates LLP, SRBC & Co., LLP and SR Batliboi & Co. LLP --as well as the partner concerned until it reached a verdict on the matter.

The ICAI’s disciplinary committee had directed the firms and the partner concerned to stop extant tie-ups with the multinational entities, as it’s circumventing the norms under the Chartered Accountants Act, 1949.

The Big Five audit firms include Deloitte, PwC, EY, KPMG and Grant Thornton.

A few partners with Big Five audit firms have alleged that since the ICAI is dominated by people who run small and mid-sized firms locally, its office bearers are dependent on accountants of these local firms for their election to the ICAI council. So, they are biased towards the interest of these local firms, they have claimed.

Governed by statutory rules

In its response on Friday, the institute said the procedure for enquiring and levying penalties is governed by the statutory rules framed by the central government. “These rules provide for the method and manner of conducting enquiries as per the procedure laid down therein in conformity with the principles of natural justice and fair procedure,” it added.

It said the issue of action against multinational accounting firms was also dealt with by the Supreme Court in its 2018 judgment in a case of S Sukumar vs the ICAI.

The matter before the apex court was whether the multinational accounting firms are operating in India in violation of the law of the land in a clandestine manner. Subsequently, the top court considered the 2003 report of a study group of the ICAI and a 2011 report on the operations of such firms in India submitted by an ICAI expert group. It also factored in various provisions of the Chartered Accountant Act, 1949, and the action initiated by the ICAI until then.

The apex court then directed the ICAI to “further examine all the related issues at an appropriate level as far as possible within three months and take such further steps as may be considered necessary”, the institute said in its response.

“In view of the above, it may please be noted that the ICAI which is a Statutory Regulator of the Profession of Chartered Accountants is discharging its duties as laid down under the Chartered Accountants Act, 1949 and the rules and regulations made thereunder,” it said.

The institute is committed to discharge its regulatory functions in accordance with due procedure established by law and in compliance with the Supreme Court direction, it added.

COMMENTS

All Comments

By commenting, you agree to the Prohibited Content Policy

PostBy commenting, you agree to the Prohibited Content Policy

PostFind this Comment Offensive?

Choose your reason below and click on the submit button. This will alert our moderators to take actions